How I’ve Streamlined My E-commerce Store and Boosted Sales with Modern Payment Solutions.

As an e-commerce merchant, I’m constantly looking for ways to improve my online store. My goal is always to make the shopping experience as smooth and enjoyable as possible for my customers, because I know that directly translates to better sales for me.

One area where I’ve seen a significant impact is in the checkout process. It’s the final hurdle, and if it’s clunky or slow, I risk losing a sale right at the finish line.

That’s why I’ve become a huge advocate for integrating mobile wallets into my Shopify store. They’ve truly revolutionized how my customers pay, and in turn, how my business performs.

You might be wondering, “What exactly are mobile wallets?” Simply put, they are digital versions of your physical wallet, stored on a smartphone or other mobile device.

They securely hold payment information, like credit and debit card details, along with shipping addresses and sometimes even loyalty cards.

For my customers, this means they no longer have to fumble for their physical cards or manually type in long strings of numbers, expiration dates, and security codes.

Think about your own online shopping habits. How many times have you abandoned a cart because the checkout process felt too long or cumbersome, especially on a mobile device? I know I have.

This “cart abandonment” is a massive pain point for all of us in e-commerce. Industry statistics consistently show high abandonment rates, and a significant portion of that is due to complex checkouts.

Mobile wallets directly address this. They offer a one-tap or one-click payment solution, drastically reducing the number of steps required to complete a purchase.

For me, this translates directly into higher conversion rates. When the path to purchase is frictionless, more customers complete their orders. It’s that simple.

Beyond speed, security is another paramount concern for me and my customers. Mobile wallets employ advanced security features that often surpass traditional card payments.

They use tokenization, which means your actual card number is never transmitted or stored by the merchant. Instead, a unique, encrypted token is used for each transaction.

This significantly reduces the risk of data breaches and fraud. My customers feel more secure, and frankly, so do I, knowing their sensitive information is better protected.

Many mobile wallets also leverage biometric authentication, like fingerprint scans or facial recognition. This adds another robust layer of security, ensuring only the authorized user can make a purchase.

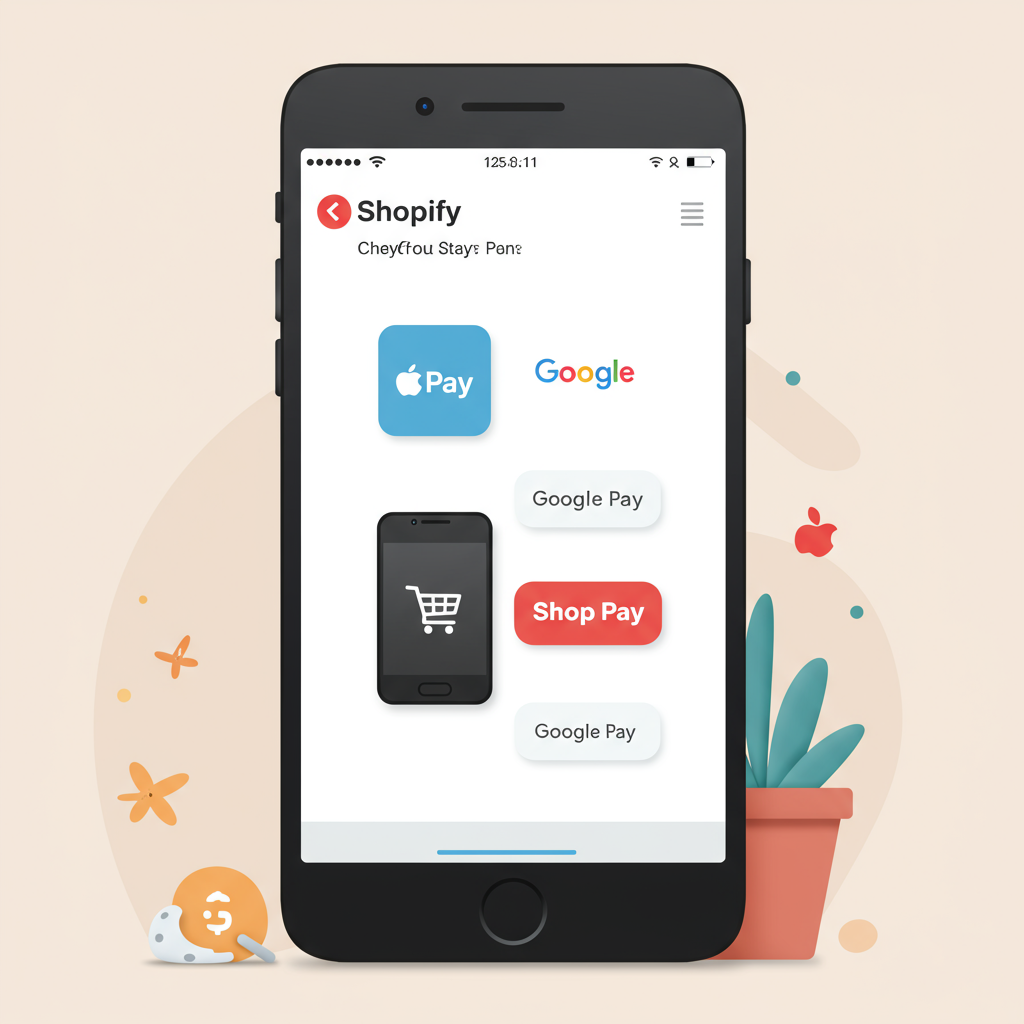

Integrating these solutions into my Shopify store was surprisingly straightforward. Shopify, being the robust platform it is, has native support for many popular mobile wallets.

The first and most obvious one for me was Shop Pay. As a Shopify merchant, enabling Shop Pay was a no-brainer. It’s Shopify’s own accelerated checkout, designed specifically for the platform.

When a customer uses Shop Pay, their shipping and billing information is securely saved across all Shopify stores. This means they can check out in seconds on my store, even if it’s their first time shopping with me, as long as they’ve used Shop Pay elsewhere.

I also made sure to enable Apple Pay and Google Pay through Shopify Payments. These are incredibly popular, especially among mobile users, and cover a vast segment of my customer base.

The setup process for these was largely automated once I had Shopify Payments configured. It was a matter of ticking a few boxes in my admin panel, and suddenly, these convenient options appeared for my customers.

I’ve also integrated PayPal, which, while not strictly a “mobile wallet” in the same vein as Apple Pay, functions similarly by allowing customers to pay with stored credentials, often with just a few taps.

My strategy has been to make these options highly visible. I ensure the mobile wallet buttons appear prominently on my product pages, right alongside the “Add to Cart” button, and certainly at the top of my checkout page.

I’ve also taken a moment to briefly explain the benefits on my FAQ page, reassuring customers about the speed and security. Transparency builds trust.

The results have been undeniable. I’ve seen a noticeable decrease in abandoned carts and a corresponding increase in completed purchases. My customers appreciate the convenience, and I appreciate the boost to my bottom line.

In today’s mobile-first world, where more and more people are shopping on their smartphones, offering these streamlined payment options isn’t just a nice-to-have; it’s a necessity. It’s about meeting my customers where they are and making their lives easier.

So, if you’re a fellow Shopify merchant, I strongly encourage you to explore and enable mobile wallets on your store. It’s a simple change that can yield significant returns.

What do you think about the impact of mobile wallets on e-commerce? I’d love to hear your perspective.

For me, it’s been a game-changer, transforming a potential point of friction into a seamless, secure, and speedy transaction. It’s about providing an exceptional customer experience from start to finish.